Individual Medical Insurance Open Enrollment November 1 – January 15

It is the time of year when:

- If you are not enrolled into an Individual Medical Insurance Plan you can enroll and you cannot be declined.

- If you are enrolled in a plan you can change to a different plan.

I am a broker. So I can help with all of the available plan options. There are plans you can enroll into directly (Kaiser and Regence) and there are plans offered on Wahealthplanfinder.org (Kasier, Regence, Premera, Ambetter, Molina, Community Health, Bridgespan, Lifewise & others.

As a broker I can help you to determine the plan choice that is best for you.

I am often asked why do I need a broker:

- 1. As an agent I have information about companies and plans options not available when calling the 800#.

- 2. This is probably most important reason, if you have a problem, or dispute I am there to help you get it resolved. No one ever expects a problem. I am there to advocate for you.

- 3. There is no addition cost for you to use a broker as we are paid by the insurance company. Using a broker does not change amount you pay.

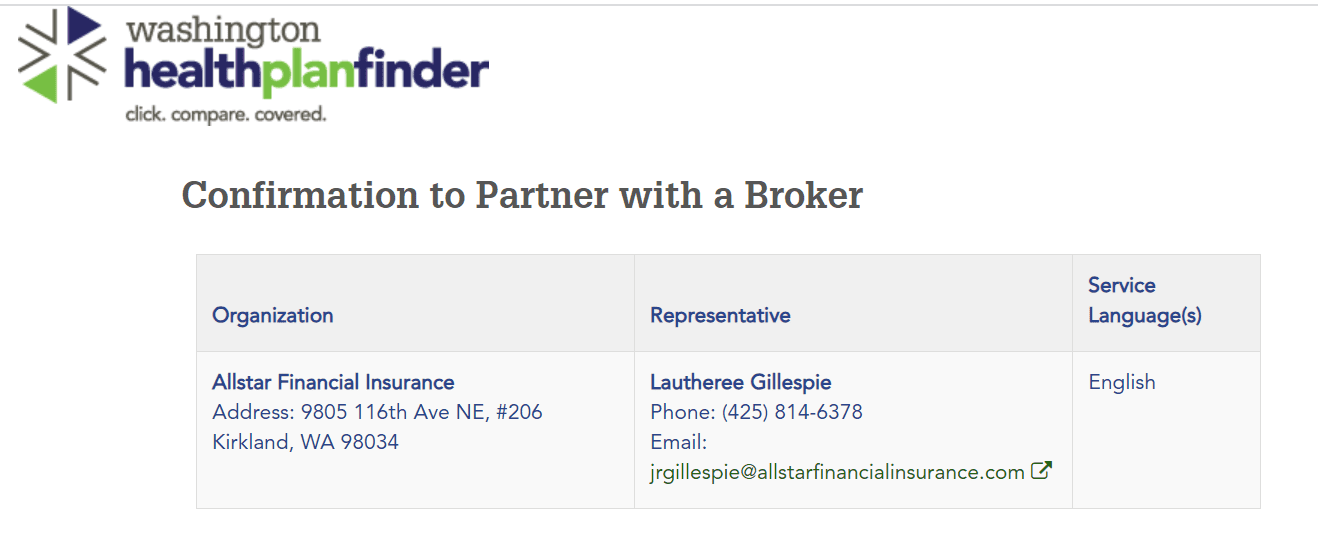

Just go to where it says Find or Manage my Broker on your dashboard or Using the Customer Support tab on the Menu Bar choose Find In-person help from a broker. You can look me up.

If you are not familiar with how our Medical Insurance system works here is a short explanation. . You pay premiums based on your age & income. Rates are less the younger you are. Also the lower your income is the lower your monthly payments. However you should know, your income is reconciled when you do your taxes. What this means is:

- If, when you do your taxes, if you’ve under-estimated your income they will say we gave you too much of a reduction and you will have to pay it back. If you over-estimate your income they will say we did not give you enough of a reduction and you will receive it then.

The #1 question I am asked is what is income? For most people it is your Adjusted Gross Income (AGI), however if you have nontaxable income (municipal bonds, etc.) you need to add that to your AGI making it Modified AGI.

The Affordable Care Act is great for people with lower incomes but if your income makes you ineligible for a rate reduction premiums can be pretty expensive. Especially for people over age 50. The SelectMed Metallic Plan is an excellent way to reduce your monthly expense.

Also the Altrua Health Medical Sharing Plan is very cost effective. With this plan you align yourself with a group that agrees to share and pay medical expenses of their members. This plan has pre-existing condition restrictions.

With 30 year experience I know how important Medical Insurance is. You do not know when you will have to endure a health problem. It can be an illness or an injury. In either case the cost can be considerable. Everyone is healthy until they are not.